Thursday, September 29, 2005

The Air America Saga

Air America, the liberal radio answer to Rush Limbaugh, is now asking its listeners to send in money, leading some analysts to say the network is "crumbling."

The network, featuring voices including Al Franken and Janeane Garofalo, has developed a program where people become "associate" members by contributing cash.

On its website, Air America lists the benefits of membership, stating, "In return for your help, we'll send you a monthly Associates insider e-mail with the backstage news from our shows and our headquarters. When we take Air America Radio on the road, we'll invite you to meet our hosts and progressive leaders in your community. And for gifts of $50 and up, we've got free stuff to send you."

Among the "free stuff," Air America is giving contributors three bumper stickers to help spread word about the programming. Gifts of $100 or more entitle listeners to "a stylin' yet functional tote bag," and for those donating at least $250, "our hosts and staff will personally thank you at this level of giving on AirAmericaRadio.com and on the air."

"We know we can't achieve this next stage of growth without significant help from you, our loyal listeners," said the network in an e-mail to supporters, according to Mediaweek, which said the "unusual move for commercial radio" was "more common to noncommercial stations and political action committees."

The problems at Air America were the subject of a segment tonight on "The O'Reilly Factor" on the Fox News Channel.

"It is really almost comical that they're putting on these sort of panhandling pleas to their audience members," WorldNetDaily columnist Michelle Malkin told Bill O'Reilly, saying bad content was key to the demise. "They've got a trail of debts, a trail of creditors. There's two stories really here. The crumbling of Air America, and the failure and the refusal of the rest of the mainstream media to cover it as a financial, political and entertainment media story."

Malkin was among the first writers to document a scandal at the network, involving hundreds of thousands of dollars reportedly diverted from the Gloria Wise Boys & Girls Club in New York to Air America. The network recently repaid the club $875,000 after the word of the diversion seeped into the national media.

>Radio analyst Brian Maloney told O'Reilly, who also hosts a radio talk show, the company clearly had a bad business model, and he's not sure it can survive.

"As things stand now, they may be down to their last couple of months," Maloney said, "but that could change at any moment if [George] Soros or one of the other big guns comes in, steps to the plate and puts up some cash. But otherwise, I think things are looking bleak. They're overpaying the air talent, they're fending off lawsuits, they're overspending. They just put a brand new studio facility in. They didn't need that. That was at Franken's insistence and now he's not even going to use it. He's moving to Minnesota. So they're wasting money, they're not bringing it in. It's a mess." But some, like media instructor Donna Halper at Emerson College in Boston, are not so sure the network's obituary should be written just yet.

"The early stumbles of a new network like Air America prove nothing," Halper, a radio consultant for 25 years, told WND. "The fact is that most talk-show hosts, no matter what their politics, have to build an audience and a commercial base slowly. Some will succeed, others will vanish."

As WND recently reported, a California radio station pleaded for advertisers to sponsor the liberal programming of Air America shows it broadcasts, claiming it could not get a single ad.

Limbaugh reacted to that news, saying, "I think this is the lesson for all of you who wish to show some sort of financial revenue income by carrying liberal radio. You have to orient yourself to fund-raising, not commerce. Commerce has never been part of the recipe here. ... You are doing something good for the cause."

Tuesday, September 27, 2005

"Clinton" and "Lewinsky" become condom brand names

A condom maker in southern China's Guangdong province is marketing its products under "Clinton" and "Lewinsky" brands and has registered the names as trademarks, state press said.

The Guangzhou Haojian Bio-science Co is selling its wares under the Chinese spelling of the names that read "Kelintun" and "Laiwensiji," the New Express reported.

The names in China are easily recognizable as former US president Bill Clinton and his one time lover, Monica Lewinsky.

The Clinton brand is set to be the company's top product selling for some 30 yuan (3.7 dollars) for a pack of 12, while the Lewinsky brand was expected to fetch 18 yuan.

The company unveiled the product on Monday. General manager Liu Wenhua expressed confidence the names would not get him into trouble since they are only "trademarks of two foreign surnames and can't be seen as a violation of rights," the report said.

Phil's ObservationsOh, come on... It couldn't get any easier than this.

Monday, September 26, 2005

2-4-1: Another One Too Good To Let Go ...

Two residents of a New Mexico town are suing to remove three crosses from the official town seal. The suit says "the crosses serve no governmental purpose other than to disenfranchise and discredit non-Christian citizens" and accuses the city of violating the plaintiff's constitutional right to religious freedom, invading their privacy, and violating the civil rights act of 1964. The mayor says he plans to fight the lawsuit since, he says, the crosses have a historical reason for being in the logo. After all, the town in question is Las Cruces, which is Spanish for "The Crosses."

This One Is Just Too Good To Forget ...

Cindy Sheehan grumbled this weekend that cable news networks were paying more attention to Hurricane Rita than to her anti-war rally in Washington, posting a message on the liberal Web site writing, "i am watching cnn and it is 100 percent rita...even though it is a little wind and a little rain...it is bad, but there are other things going on in the country today...and in the world!!!!"

That was too much even for some Daily Kos readers. One responded, "shame on you, you're jealous of media coverage of other's suffering," while another wrote, "The right-wing media has painted you as a self-centered, self-absorbed woman and you're living up to that image." Sheehan later posted an apology.

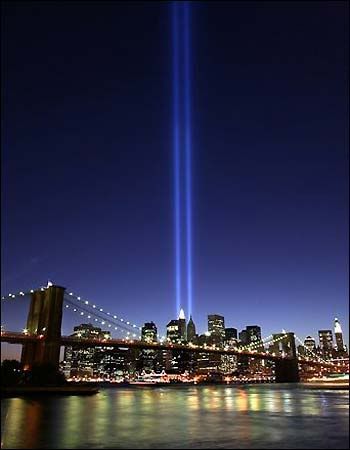

Sunday, September 11, 2005

A Picture Speaks A Thousand Words

Nothing else needs to be said.

Friday, September 09, 2005

Closed Grade School Morphed into Community Center

LEAF RIVER -- Mark and Andrea Pellini have spent more than 100 hours at the shuttered Leaf River Grade School working with other parents to prepare the building for its new role as a community center.

Residents angered by the school's closing last year opted to turn their frustrations into action.

Forrestville Valley School District officials voted to close the school in March 2004, citing financial concerns for the district. The move displaced about 160 students and staff members who eventually were absorbed into other district schools.

Parents packed School Board meetings to protest the decision, many wearing save-the-school T-shirts and carrying signs. At one point, they tried to sue the School District, but the effort failed.

When the building turned up for sale this year, the village approached the School District with the community center plan in mind. The district complied, selling the building to the village of Leaf River for $1.

"The town had mixed emotions about buying it," Mark Pellini said. "Now that it's been purchased, the community has put a lot of effort into the building and gotten it to a good point."

Parents and residents have spent countless hours cleaning, painting and getting the building in working shape. An eight-member board has been appointed to oversee the center's activities.

The building at 608 Main St. now carries the name River Valley Complex. An open house is set for Saturday.

The building has a big gym, so Pellini said the group wants to lure sports leagues to practice and play there. The Leaf River Lions Club spent about $3,000 on kitchen renovations, meaning the building can host wedding, anniversary, birthday and holiday receptions or family reunions.

Village Hall offices and the Police Department have moved into the building. It has 21 rooms, and about four are completely occupied. Pellini said the board is willing to rent out classroom space for small businesses. He added that interest already has surfaced for that plan.

Weights and other fitness equipment were donated, so the group hopes to one day hold open gym nights two to three times a week for residents. They also envision holding activities like tumbling, cake-decorating or CPR.

The land also includes two baseball diamonds and the school's old football field. Village officials maintain the building's exterior, and volunteers oversee the interior work.

"Our purpose was that it wasn't going to sit there and rot," Pellini said. "It's gonna be used. It's a large complex that we can do a lot with. We see a lot of potential good coming out of it."

The Lions Club hosts a variety/talent show fundraiser for the complex at 7 p.m. Oct. 15 at the building. If you can't attend Saturday's open house but would like to donate to the cause, call Mark or Andrea Pellini at 815-738-2712.

Phil's Observations

What a great example of a community coming together.

Thursday, September 08, 2005

NSA Advisor Berger Sentenced

WASHINGTON — Sandy Berger, President Clinton's national security adviser who was once entrusted with the nation's most sensitive secrets, was fined $50,000 Thursday for taking classified documents from the National Archives.

U.S. Magistrate Judge Deborah Robinson handed down the punishment in federal court, stiffening the $10,000 fine recommended by government lawyers. Under the deal, Berger avoids prison time but he must surrender access to classified government materials for three years.

"The court finds the fine is inadequate because it doesn't reflect the seriousness of the offense," Robinson said, as a grim-faced Berger stood silently.

She also sentenced Berger to two years' probation and 100 hours of community service.

Earlier in the hearing, Berger made a short emotional plea that admitted fault and expressed remorse for his crime.

"I let considerations of personal convenience override clear rules of handling classified material," said Berger, calling his actions a lapse of judgment that came while he was preparing to testify before the Sept. 11 commission last year.

"In this case, I failed. I will not again," he said.

The sentencing capped a bizarre sequence of events in which Berger admitted to sneaking classified documents out of the National Archives in his suit, later destroying some of them in his office and then lying about it.

Berger's lawyer, Lanny Breuer, said his client will not appeal the sentence.

The Bush administration disclosed the investigation in July 2004, just days before the Sept. 11 commission issued its final report. Democrats claimed the White House was using Berger to deflect attention from the harsh findings, with their potential for damaging President Bush's re-election prospects.

Initially saying his actions were an "honest mistake," Berger later pleaded guilty in April to a misdemeanor of unauthorized removal and retention of classified material, which contained information relating to terror threats in the United States during the 2000 millennium celebration.

During Thursday's hearing, Breuer characterized Berger as an official eager to get the facts of the Sept. 11 attacks right when he improperly took classified documents and handwritten notes from the Archives.

"The tragedy of 9/11 weighed heavily on him," Breuer said.

Robinson repeatedly questioned Breuer and government lawyers about a provision in federal law that calls for examining a defendant's financial background when issuing punishments. Both attorneys responded that they believed a $10,000 fine was still appropriate.

The Associated Press first reported in July 2004 that the Justice Department was investigating Berger. The disclosure prompted Berger to step down as an adviser to the campaign of Democratic presidential candidate John Kerry.

Clinton was among the Democrats who questioned the timing of the disclosure of the Berger probe three days before the release of the Sept. 11 report. Leaders of the Sept. 11 commission said they were able to get every key document needed to complete their report.

Phil's Observations

I wonder what kind of things he did while he was in office ....

I'm Angry

WASHINGTON — The government's $5 billion effort to help small businesses recover from the Sept. 11 attacks was so loosely managed that it gave low-interest loans to companies that didn't need terrorism relief — or even know they were getting it, The Associated Press has found.

And while some at New York's Ground Zero couldn't get assistance they desperately sought, companies far removed from the devastation — a South Dakota country radio station, a Virgin Islands perfume shop, a Utah dog boutique and more than 100 Dunkin' Donuts and Subway sandwich shops — had no problem winning the government-guaranteed loans.

Dentists and chiropractors in numerous cities, as well as an Oregon winery that sold trendy pinot noir to New York City restaurants also got assistance.

"That's scary. Nine-11 had nothing to do with this," said James Munsey, a Virginia entrepreneur who described himself as "beyond shocked" to learn his nearly $1 million loan to buy a special events company in Richmond was drawn from the Sept. 11 program.

"It would have been inappropriate for me to take this kind of loan," he said, noting that the company he bought suffered no ill effects from Sept. 11.

Arvind "Andy" Patel, 50, said he used his $350,000 loan in fall 2002 to remodel his Dunkin' Donuts shop in western New York state and never knew it was drawn through the Sept. 11 program.

"Not at all," Patel answered, when asked whether his business had been hurt by the attacks.

Government officials said they believe banks assigned some loans to the terror relief program without telling borrowers. Neither the government nor its participating banks said they could provide figures on how many businesses got loans that way.

But AP's nationwide investigation located businesses in dozens of states who said they did not know their loans were drawn from the Sept. 11 programs, suggesting at least hundreds of millions of dollars went to unwitting recipients.

The Small Business Administration, which administered the two programs that doled out Sept. 11 recovery loans, said it first learned of the problems through AP's review and was weighing whether an investigation was needed. But officials also acknowledged they intended to spread the post-Sept. 11 aid broadly because so many unexpected industries were hurt.

"We started seeing business [needing help] in areas you wouldn't think of — tourism, crop dusting, trade and transportation. ... So there were a lot of examples you wouldn't think of, at first blush," SBA Administrator Hector Barre to told AP.

In all, the government provided, approved or guaranteed nearly $4.9 billion in loans, and took credit for saving 20,000 jobs. That would put the average cost of saving a job at about a quarter million dollars each.

Of the 19,000 loans approved by the two programs, fewer than 11 percent went to companies in New York City and Washington, according to an AP computer analysis of loan records obtained under the Freedom of Information Act.

"I had nothing here," said Shirla Yam, who runs a clothing store in the former shadows of the twin towers that got a $20,000 grant from a local advocacy group but no federal aid after Sept. 11. "I don't know if I'll be here next month."

Under one of the programs, SBA lent money directly to companies that provided detailed statements on how they were hurt. The other program provided incentives — and guaranteed loans from default — so banks could lend money to companies they determined were hurt by the post-Sept. 11 economic downturn.

Most loans were well below market rates — as low as 4 percent, documents show.

SBA officials acknowledged the second program, the Supplementary Terrorism Activity Relief (STAR), left banks on an honor system to determine worthy loan recipients.

"One lender could have been really strict and specific about the borrower providing the documentation to prove that they were affected by the Sept. 11 attacks, and another banker may not have, or may have had ulterior motives for approving loans," said SBA spokeswoman Carol Chastang.

SBA documents obtained by AP show banks had a strong incentive to approve as many loans as possible from the terror program. The banks profited from the interest while incurring little risk because the government guaranteed 75 percent to 85 percent of each loan.

And the annual fee the lenders paid to SBA to get the government guarantee was slashed from 0.5 percent to 0.25 percent — meaning lenders saved an additional $5,000 a year for every $2 million they loaned under STAR.

"There was definitely an advantage to the lender to get that reduced fee," said Christopher Chavez, an SBA official in Colorado. He said he suspects lenders might not always have talked to businesses about damage from Sept. 11 before moving loans into STAR.

While SBA officials expressed surprise at AP's findings, banking officials said the agency encouraged the industry to use the post-Sept. 11 programs liberally, especially when its normal guaranteed lending program was hit by steep budget cuts in 2002.

"They had personnel at our conference stand up and say if you cannot find a reason to move the loan over to the STAR program, contact us and we'll help you find a reason to move it over," recalled Tony Wilkinson, president of the National Association of Government Guaranteed Lenders.

A bank that provided an SBA-backed loan to a trucking firm in Indiana acknowledged it did not tell the recipient about the Sept. 11 connection. "We don't have any indication there was any communication or provisions we shared with the client that these were funds from the government used to support them from Sept. 11," said Pat Schubah, first vice president of small business banking at Indianapolis-based Union Federal.

Major lenders like Wachovia and Wells Fargo declined to say how many loans they shifted into the terror relief program, saying only that they followed the law.

Wells Fargo, the nation's second largest SBA lender, said the STAR program enabled lenders "to provide funds to new and mature businesses impacted by 9/11" and the bank "continues to strictly adhere to SBA operational standards for all SBA loan originations."

Many loans went to local outlets of some of America's most famous and lucrative companies. For instance, 55 Dunkin' Donuts shops across the country, 14 Quiznos sandwich shops and 52 Subway sandwich shops got loans. Fourteen Dairy Queens — part of the ice cream franchise partly owned by Wall Street billionaire Warren Buffett — won more than $5 million in loans.

"I just applied for the loan at the bank. I had no idea where the funds came from," said Tom Mayl, who got two SBA Sept. 11 loans totaling more than $800,000 to open a Subway shop in suburban Dayton, Ohio, and a Buffalo Wild Wings restaurant in Sidney, Ohio.

"It doesn't seem right, just on the surface, but I really don't know the details," Mayl said.

Don Robinson said he too didn't need or ask for terrorism relief when he got a $765,000 government-backed loan in 2003 — drawn without his knowledge from the Sept. 11 program — to start a motorcycle shop in Brigham City, Utah.

"Actually, the motorcycle industry grew after 9/11," Robinson said. "People just took their money out of the stock market to buy toys."

Dentists and chiropractors also were frequent, but unwitting, beneficiaries. "They weren't putting their health second to anything else," chiropractor Colby Shores said of his patients in the suburbs of Rochester, N.Y. He was unaware his $87,000 loan with a 4 percent interest rate came from the terror relief program.

The loan patterns uncovered by AP left some seething in the neighborhoods directly scarred by Sept. 11.

"You have to take it back and give it to us. Even now, I could use it," said Mike Yagudayev, who said the SBA would only provide him $20,000 of a $70,000 loan he requested to rebuild his hair salon flattened by the collapse of World Trade Center towers in New York.

"I said, `You know what, take it back. Twenty thousand is like an insult,"' he recalled.

Thousands of businesses far from the devastation had no trouble getting SBA loans, simply submitting short applications that linked their slow business to the widespread economic fallout caused by Sept. 11. For instance:

—Karl Grimmelmann, general manager of KBFS-AM "Hit Kickin' Country" in Belle Fourche, S.D., borrowed $135,000 from SBA's disaster program after learning about it from a news release. He said his station was forced to pay more money to cover national news and also lost advertisers. "Everybody started holding onto their money, plain and simple," he said.

—Margie Olson, co-owner of the Torii Mor Winery in McMinnville, Ore., said her business needed a $125,000 loan because it couldn't sell high-end pinot noir to Manhattan restaurants that had closed. "Everyone started hitting the heavy stuff," Olson said, laughing.

—Melva Kravitz, co-owner of the Little Dogs Resort & Salon in Salt Lake City that offers boarding and grooming services for small dogs, said people stopped taking vacations and boarding their pets after Sept. 11, requiring her $50,000 loan. "It was awful," she said. "You just couldn't go on."

—Christine Hilty, co-owner of Violettes Boutique on St. Croix in the U.S. Virgin Islands, said the perfume shop lost 60 percent of its business overnight as tourism stopped. She got a $169,500 loan from SBA. "Would we have closed our doors? It was close," she said. "Everyone was afraid to get on a plane. Tourism was totally halted."

Though the loan programs have ended, the government is inheriting a residual burden. Already, taxpayers have been forced to cover about 600 defaulted disaster loans — some approaching $1 million each — from companies that went bankrupt or closed. More defaults are expected.

Jim Hammersley, who runs the SBA's collection arm, said many applicants asked for too much or too little money to keep their businesses afloat.

"The folks that were dealing with the aftermath of 9/11 didn't have anything that certain to try and gauge whether they needed money or how much they needed," he said.

Phil's ObervationsI'm angry at the negligence and stupidy. My tax dollars wasted again. I usually support the SBA, but this is pathetic. And the fact that our Congress wrote the laws/guidelines/rules so loosely pisses me off.

Sunday, September 04, 2005

Racism Card Played Again ... And Again ... And Again

Racism is partly to blame for the deadly aftermath of Hurricane Katrina, the Rev. Jesse Jackson said, calling President Bush's response to the disaster "incompetent."

"Today, as the President comes to Louisiana, Alabama and Mississippi for his ceremonial trip to look at the victims of the devastation, he would do well to have a plan more significant than a ceremonial tour," Jackson said Friday.

"His whole response is unacceptable."

Bush has acknowledged that the federal response has not been acceptable, but promised that the government would get supplies to survivors and crack down on violence in New Orleans.

Jackson questioned why Bush has not named blacks to top positions in the federal response to the disaster, particularly when the majority of victims remaining stranded in New Orleans are black: "How can blacks be locked out of the leadership, and trapped in the suffering?"

"It is that lack of sensitivity and compassion that represents a kind of incompetence."

U.S. Army Lt. Gen. Russell Honore, head of the military task force overseeing operations in the three states, is black. His task force is providing search and rescue, medical help and sending supplies to the three states in support of the Federal Emergency Management Agency.

Jackson was in Baton Rouge to take part in a local project using a caravan of buses to pick up people stranded in New Orleans and transport them out. He spoke at a news conference at the state emergency center.

The civil rights leader said the flooding that caused thousands to be trapped inside the city was caused by a lack of federal funding for its levee system and hurricane planning. The resulting tragedy, he said, has largely hit New Orleans' black residents, because they were too poor to evacuate before the storm hit.

"There's a historical indifference to the pain of poor people and black people" in this country, he said.

Jackson also said the news media has "criminalized the people of New Orleans" by focusing on violence in the city.

Phil's Observations

I think Jesse forgot to mention that the vast majority of New Orlean's government is controlled by his race. The majority of the now-wiped-out New Orleans was also controlled by corruption, all the way up and down the line. Remember, according to Jackson, all blacks appointed by Bush are just figure heads that follow his every lead and have no power. Yet, he still calls for more. Can't you ever get your story straight, Jesse? You even screwed up your marriage by having an affair and a child out of wedlock. Hmmmmm ....